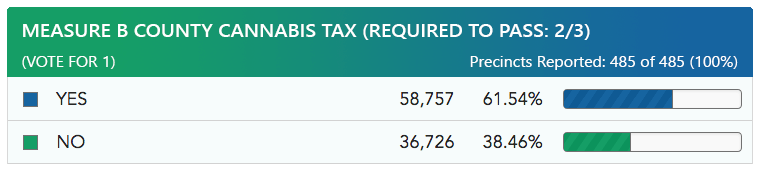

Measure B Failed to Pass by the Required 2/3 Majority.

On November 6, 2018, the voters of San Joaquin County failed to pass Measure B, the special tax on

all commercial cannabis activity in the unincorporated County. Accordingly, the Title 4, Division 10, Chapter 1

Commercial Cannabis Business ordinance will not become operative and the corresponding Title 9 amendments will not

move

forward. The ban on commercial cannabis businesses in the unincorporated areas of San Joaquin County will remain in

place.

July 10th, 2018 | Board Leter

Commercial Cannabis Business Tax Info Sheet

FAQs

A proposed special tax to fund early childhood education, public health and safety, drug prevention, and the enforcement of cannabis laws by taxing all medical and adult-use (non-medical) commercial cannabis business activity in the unincorporated areas of San Joaquin County.

The Tax will appear on the November 6, 2018, ballot as Measure B and will only become operative if it is approved by a 2/3s majority vote.

All types of medical and adult-use commercial cannabis businesses will be allowed in the unincorporated County except outdoor cultivation and cannabis events.

What cannabis activities are subject to the Commercial Cannabis Business Tax? All medical and adult-use commercial cannabis activities including cultivating, distribution, manufacturing, storing, testing, and selling cannabis.

To impose a tax on all commercial cannabis activities to ensure that there are sufficient funds to enforce cannabis laws and to provide a stable, long-term funding source for essential services like early childhood education, childhood literacy, other programs for children and youth, public health, public safety, enforcement of cannabis laws, and drug prevention.

The tax rate will be set by the Board of Supervisors between 3.5% to 8% on gross receipts of all commercial cannabis business activity. Cultivators (excluding nurseries) will also be required to pay a Square Footage Payment of $2.00 per s/f of cannabis cultivation that will be credited back upon collection of the tax on gross receipts.

The total amount of value actually received or receivable from all sales or service.

The Square Footage Payment is calculated based on the "Cultivation Area," which is the area of cultivation authorized by the County Cannabis Business license without deducting for unutilized square footage.

Based on a 2017 Fiscal Analysis of the Potential Commercial Cannabis Industry in San Joaquin County the total estimated annual tax revenue is $2,302,750. This is based on an assumed tax rate of 5% on 9 non-cultivation businesses and 11 cultivation sites utilizing the maximum allowed square footage.

Tax funds will be placed in a special fund that can only be used in two ways; to fund "early childhood education and other programs for children and youth, such as childhood literacy, gang reduction, after-school programs and drug prevention programs" or to fund “public health, public safety, and cannabis enforcementâ€

the childhood programs will increase by 5% each year until year five. The fifth year and each succeeding year the funds will be evenly split between youth programs and enforcement.

A Special Tax Oversight Committee including experts in the areas of youth programs and enforcement will provide an Annual Review Report and recommendations to the Board of Supervisors regarding allocation of the Tax funds. The county cannot change the types of programs the Tax revenue may be spent without a vote of the people.

No, the Commercial Cannabis Business Tax applies to all medical and non-medical commercial cannabis business activity. However, consumer purchases of medical cannabis

For information on commercial cannabis ordinance developments, public hearings, and workshops sign up for notifications here.